In a perfect world, your savings and investments cover all your final expenses and help care for your loved ones after you’re gone. But this is far from the reality for most, which is why maintaining adequate veterans’ life insurance isn’t just important, it’s crucial.

Military life insurance differs from private policies. As an active duty member, you received life insurance as part of your benefit package. However, that changed once you transitioned to civilian life. While veterans can enroll in Veterans Group Life Insurance, VGLI often costs more than comparable private plans on the open market. Why spend more than you must?

Life insurance is vital for everyone, and America’s service members are no different. But you have other options. Ready to learn how to save more money each year and ditch the expensive VGLI?

What is VGLI?

The United States Military offers Veterans Group Life Insurance to members after they leave the service. The program is optional, and enrollment takes place during a window around the time of separation. VGLI allows you to maintain life insurance coverage, regardless of health, and in amounts up to $500,000. The military offers other life insurance programs, often for smaller amounts and at no cost, to some individuals as part of a disability program; these differ from VGLI.

How Does VGLI Pricing Compare to Other Life Insurance?

VGLI is substantially more expensive than private life insurance. If you’re relatively healthy, you may qualify for standard or better rates. VGLI programs also increase in cost every five years, where your age ends in a “0” or a “5” (40, 45, 50, 55, etc.). So not only can you get a better deal in the present with a private plan, but you can lock in a level term for 10, 15, 20, or even 30 years.

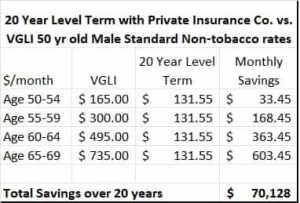

Here is an example: A 50-year-old male (even a regular cigar smoker) can get a $500,000 death benefit 20-year level term policy for under $132 per month. A $500,000 death benefit with VGLI is $165 per month from age 50-54, then jumps to $300 at age 55, $495 at age 60, and $735 at age 65! Over 20 years, the savings on the private veterans’ life insurance policy is over $70,000. That’s a lot of cigars!

It is easy to see exactly what your VGLI rates will be as you get older. Just check out this link to the VA on the official va.gov website. Scroll about halfway down the page to where you see different age brackets. You can then use the quote form on the Cigar Life Guy webpage to do a comparison. Remember to look at the total cost over the entire term as the private policy cost stays flat while the VGLI increases every five years.

Why Do People Keep Overpaying For VGLI?

Many people don’t know how much they can save by going through a private insurer. The premiums for VGLI often are deductions from a benefit check (like a pension). So you don’t see the money flowing out of your bank account. Instead, it’s a line item deduction on a payment stub.

Another big reason you might keep VGLI despite the high cost is you must be able to qualify for private veterans’ life insurance. Some veterans cannot medically qualify for private life insurance, leaving VGLI as their only option.

I’m on VA Disability; Will I Qualify for Life Insurance?

Your ability to qualify for life insurance depends on your underlying health reasons for the disability. Often, orthopedic conditions, like back conditions, are not a problem assuming you aren’t on opioid or narcotic pain medication. PTSD depends on the severity of the case (typically “mild” is fine), the type of medication you are on, and your current employment status. Working full-time may improve your insurability with any mental health condition. However, if you receive Social Security Disability benefits, you will not qualify for a private life insurance plan comparable to VGLI.

I Smoke Cigars; Can I Still Get a Great Rate on Life Insurance?

Absolutely! Cigar Life Guy helps cigar smokers receive non-tobacco rates on life insurance, and veterans are no exception. A regular cigar smoker will qualify just the same as non-those who don’t smoke cigars for the standard, non-tobacco rates in the example noted above.

How Do I Start the Application Process?

First, reach out to Cigar Life Guy. You can fill out a quote form on this page or call us directly at 888-80CIGAR (888-802-4427). You can expect to have a brief, no-obligation phone conversation about your situation. We’ll discuss any health considerations that may affect your eligibility, and we’ll go over some prices. Learn more about the process here.

Remember, it’s essential to have your new policy in place and active. This includes making your first payment before canceling your existing VGLI coverage. While VGLI may be expensive, it’s better than nothing if you don’t qualify elsewhere.

Enjoy a cigar! We thank you for your service. If you’re still holding on to VGLI, remember, you might save thousands of dollars by switching to private life … and that’s a lot of cigar money!

*Comparison is to an A+ rated life insurance carrier for a male age 50, standard non-tobacco rates, pulled from Compulife® Nov. 2023. Rates are subject to change and plans will require underwriting. This is not an offer of insurance. A daily cigar smoker in average or “standard” health should qualify for this rate class.

Photo credit: Cigar Life Guy